10 simple steps to keeping your money

Managing a student budget: lead your best life and don’t go broke

Budgeting. Yes, the dreaded word that makes every student quake in their boots. The truth is, I LOVE to budget. Everything in, everything out – it’s all documented. Trust me when I say, it’s not as difficult (or as scary) as you may think.

I’m going to take a leaf out of Andie Anderson’s book, but don’t worry, I’ve got something more useful than telling you how to lose a guy in 10 days, and that is ‘how to budget your money with 10 simple tips’.

Tip #1: Plan to spend more than you have

First things first, get an arranged overdraft. Unauthorised overdrafts are incredibly expensive. Make the most of the benefits of being a student, while you can. Talk to your bank or look at other banks and see what they can offer you. Have a look at Moneysupermarket.com/current-accounts for some comparisons.

Tip #2: Time to Excel

Create a spreadsheet. This is so much easier and less time consuming than you may think. It could honestly save your life.

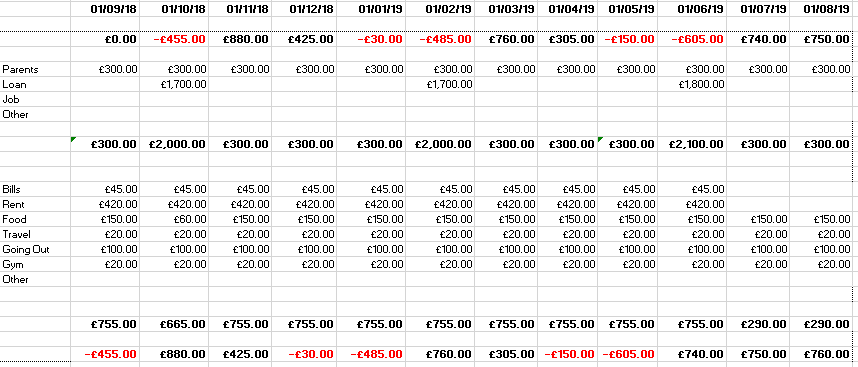

It helps you know how much money you have and how much you can spend, based on your income and your expenses – things you need to buy.

And because I’m feeling particularly generous, I’ve included the very same template that I use to take control of my finances. If you’re not experienced with a spreadsheet, I’ve also added a few simple steps to get you started.

Using a simple excel spreadsheet is a super simple way to manage your spending.

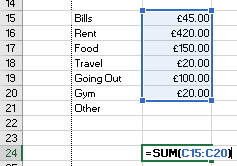

To find you out how much you’re spending every month, add up all of your outgoings. This would be things like your rent, food and money for going out. Don’t forget to include things like gym memberships and your Netflix and Prime subscriptions!

Do the same for your income – your student loan, money from your part time job and any bursaries or grants you might have.

The quickest way to add things up in Excel is using the SUM function. Maths genius.

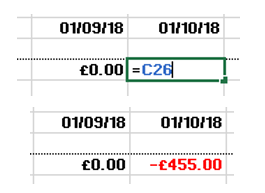

To see what money you should have at the end of the month, add together the amount of money you started the month with and money that you know us coming in. Then subtract your outgoings for this figure. This will be the amount of money you have for the next month.

The amount of money you have left at the end of this month = what you start next month with!

If all of that seems like weird black magic, you can download a simple budget management template, here.

Tip #3 Go back to basic

Make sure you know the basics of what is coming in, and what’s going out. Student loan, rent, bills, food, nights out, factor EVERYTHING in.

Your excel spreadsheet will come into its own here.

Of course, everyone goes off plan — so be realistic. Don’t tell yourself you’ll only spend £20 a month on nights out, because you’ll be in for a nasty surprise!

Tip #4 Balance

Check your bank balance, religiously. I may be in too deep, but I must admit, I check my balance every few hours. Ever feel anxious to look at your bank balance? Put it off for weeks on end? Get into the habit of checking it every day. If you don’t know how much you’ve got, how do you know how much you can spend?

Also, by not checking regularly it, you’ll build it up into a terrible event. But, what’s worse: checking your money regularly, or finding your account’s maxed out at the supermarket or on a night out?

Tip #5 Data is your saviour

Update your spreadsheet.

Whether you do this once a week, once a day, or every time you spend (guilty), at least you’ll have a better idea of your financial situation.

Tip #6 The Zen of overdrafts

‘Wow, you’re so deep into your overdraft, what are you going to do?’. I get this question a lot. But you know what, it is all planned for. Now, here comes a shocker. Are you ready for it? Being in your overdraft is… FINE (as long as you’ve followed tip 1)! That’s what it’s there for.

Tip #7 Your friends’ finances

Keep track of what your friends owe you. Paid for a cheeky late-night treat for you and all your pals? Or maybe you’re always the one getting the Uber?

I know that asking for money back can be awkward, but before you know, you’ll be out of pocket with no idea where it all went.

Tip #8 Honesty is the best policy

Be honest with your friends if you can’t afford something. Everyone is new to this and no one really knows what they’re doing. Your friends won’t hate you if you skip one night out, there will be plenty more!

Tip #9 Find help

If you’re having money trouble, get some advice, as soon as you can. There’s plenty of help out there. At University of Birmingham, you can find advice, here: https://www.birmingham.ac.uk/undergraduate/support/moneyadvice/index.aspx. All universities and Student Unions will have advice centres. Remember, don’t struggle on alone.

Tip #10 Enjoy yourself

Life isn’t all about money, and you have to be able to go out, socialise and buy that cheeky Nandos. But just remember to be aware of what you’re spending. It’s so easy to get lost in the whirlwind of student life and end up with no money.

Think smart, spend smart.

Image by William Iven from Pixabay