What do the recent budget changes mean for investors in student property?

Now the dust has settled around the Chancellor’s recent budgets, we’ve put together our thoughts about the impact for property investors.

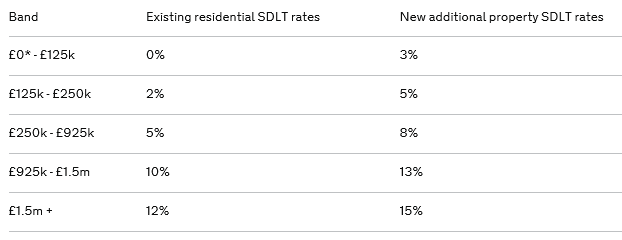

Stamp Duty

Although the increase in stamp duty on rental properties had previously been announced, many investors had hoped that the proposal would be watered down and perhaps limited so that those owning 15 or more properties would not be required to pay the higher rate. Unfortunately Mr Osbourne was not swayed by any of the results of the consultation and has implemented this increase without amendment.

As of 1st April, all buy-to-let property purchases will be subject to an additional stamp duty charge of 3% on top of the already existing charges.

We saw a surge in sales before the 1st April deadline and had anticipated a slump in sales afterwards, we are, however, already seeing a number of sales agreed which won’t exchange until after the deadline.

With margins in property investment being hit by various tax changes and student property continuing to offer the highest returns of all property sectors, we anticipate investment in student property won’t necessarily decline, it may in fact continue to expand as investors in residential property look to diversify their portfolios by adding student properties.

Capital Gains Tax

The Chancellor announced a reduction of CGT for higher rate tax payers from 28% to 20% and for lower rate tax payers 18% to 10% which will come into effect for the tax year starting April 6th 2016. The Annual Exempt Amount has been increased marginally from £11,000 to £11,100 per year for the financial year 2016-2017.

Unfortunately, the government decided to extend its attack on landlords by not applying this tax reduction to investment property so those investors selling properties which they own directly will continue to pay the higher rate of Capital Gains Tax.

The tax reduction will however, still apply to the proceeds of a sale of a company which owns a property.

This, combined with the earlier announcements about reduced tax relief for mortgage interest payments is likely to encourage more property investors to use a company structure for new property purchases and to consider transferring existing portfolios into the same.

If you are thinking of investing in property we suggest that you discuss a company structure with your accountant before making a purchase.

If you already own buy-to-let property it is prudent to seek advice about transferring your existing properties into a company structure. A great deal of advice has already been published on this subject; much of it won’t be verified until it has been tested; there is though, no rush to make the transition as the tax changes are to be phased in between 2017 to 2020.