Budget Update 2024: Capital Gains Tax Down, Stamp Duty Relief Gone, Holiday Let Relief Going

The Chancellor, Jeremy Hunt presented his spring budget 2024 on March 6th. Along side the 2p drop in employees national insurance rate there were three stand out policies which will affect property investors:

1. Capital Gains Tax Reduction

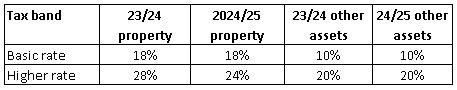

Change: Property disposal CGT fall from 28% to 24% for higher rate tax payers

Is it certain? Yes

When will it happen? Sales which exchange from 6th April 2024

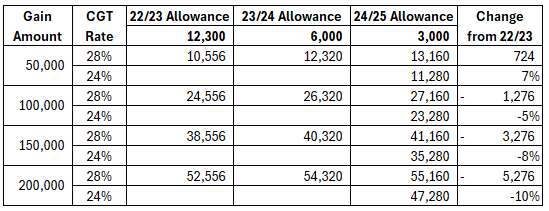

Jeremy Hut is hoping that this cut will actually lead to an overall increase in CGT revenue for HMRC as it will encourage more asset disposals. This reduction in the rate will mitigate in some instances the reduction in the tax free allowance for capital gains announced by Jeremy Hunt in 2023 which saw the allowance fall from £12,300 to £6,00 on 6th April 2023, to £3,000 from 6th April 2024. Important to note, CGT is triggered when unconditional contracts have been exchanged.

With the two changes in CGT combined, it’s those with larger gains who are set to benefit the most. For higher rate tax payers, capital gains of less than £68,100 would still see a net increase in CGT in 24/25 compared with

New Capital Gains Rates 24/25

Effective Change of CGT since 2023 (higher rate tax payers)

Quotation from the budget

“3.28 The government will implement a change to Capital Gains Tax (CGT) to support the housing market The higher rate of CGT for residential property disposals will be cut from 28% to 24%. The lower rate will remain at 18% for any gains that fall within an individual’s basic rate band. This will encourage landlords and second home-owners to sell their properties, making more vailable for a variety of buyers including those looking to get on the housing ladder for the first time, while also raising revenue over the forecast period. Private Residence Relief will remain in place, meaning the vast majority of residential property disposals will pay no CGT.”

2. Stamp Duty Multiple Dwellings Relief Abolished

Change: Multiple Dwellings Relief of Stamp Duty Land Tax Abolished

Is it certain? Yes

When will it happen? For any sales exchanged after 6th March 2024 which don’t complete before 1st June 2024

The Multiple Dwellings Relief could provide significant reductions in CGT paid in instances where multiple properties are purchased at the same time, or in linked transactions. If you are in the midst of a transaction which will benefit and contracts have not been exchanged, the clock is ticking for 1st June!

Quotation from the budget

“3.30 From 1 June 2024, the government is abolishing Multiple Dwellings Relief, a bulk purchase relief in the Stamp Duty Land Tax regime. This follows an external evaluation which showed no strong evidence the relief is meeting its original objectives of supporting investment in the private rented sector. Property transactions with contracts that were exchanged on or before 6 March 2024 will continue to benefit from the relief regardless of when they complete, as will any other purchases that are completed before 1 June 2024. The government will engage with the agricultural industry to determine if there are any particular impacts for the sector that should be considered further.”

3. Furnished Holiday Lettings (FHL) tax regime

Change: Furnished Holiday Lettings (FHL) tax regime to be abolished.

Is it certain? Not, legislation is required and this government doesn’t have a lot of legislation time left to play with.

When will it happen? If the legislation is approved, April 2025.

Under the FHL regime, landlords who let out short-term furnished holiday properties enjoyed tax advantages over those who rented out residential properties to longer-term tenants.Key benefits included:

- Capital Gains Tax Relief

- Plant and Machinery Capital Allowances

- Earnings for Pension Purposes

- Deducting Mortgage Interest Payments

Residential letting landlords had to deal with a similar change brought in under Section 24 of the Finance Act 2015 which saw a gradual reduction in landlords’ rights to of set fiance costs against their rental income. The result of this legislation saw many landlords selling up, and a drastic increase in rental properties being transferred to or bought into limited companies where the financing costs could still be offset against income. The costs/benefits of this approach vary from person to person so please speak to your accountant for the best advice.

Comment: If implemented, these changes will have significant affects on the holiday letting market with a likely increase in transactions and consolidation of the market as smaller holiday let owners selling up.

Quotation from the budget

“3.29 The government will remove the current incentive for landlords to offer short-term holiday lets rather than longer-term homes by abolishing the Furnished Holiday Lettings (FHL) tax regime. This will level the playing field between short- term and long-term lets and support people to live in their local area. This will take effect from April 2025 and draft legislation will be published in due course.”

Book a call with one of our property experts

Reference:

HC 560 – Spring Budget 2024 (publishing.service.gov.uk)

Spring Budget 2024: what does it mean for investors? – Which? News