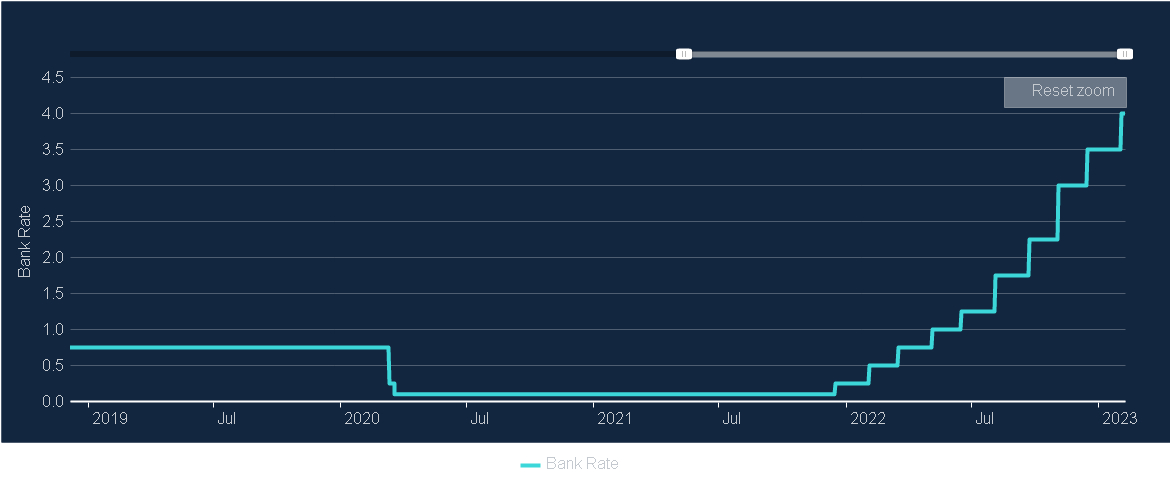

Bank of England Base Rate Increase – February 2023 (4%)

The Bank of England‘s Monetary Policy Committee decided to raise the Bank Rate by 0.5 percentage points to 4% in February 2023; this is the 10th successive rate increase.

The move is in response to global consumer price inflation remaining high, although likely to have peaked, and UK domestic inflationary pressures being firmer than expected. The MPC’s current projections indicate CPI inflation falling back sharply from its current very elevated level, of 10.5% in December, to around 4% towards the end of this year and below the 2% target in the medium term.

The MPC will continue to monitor closely indications of persistent inflationary pressures and adjust Bank Rate as necessary to return inflation to the 2% target sustainably.

What’s happening to mortgage interest rates?

“The consensus is that mortgage rates will gradually decline throughout the year, even if interest rates go up. Some predict that fixed rates could fall below 4 per cent by early 2024.

The reason is because most lenders priced in higher future interest rates in response to then-chancellor Kwasi Kwarteng’s September mini-Budget proposals, which contained £50bn of unfunded tax cuts. This shook the mortgage market, with rates rising to levels not seen since the 2008 financial crisis.

Rates have marginally reduced since – largely because current chancellor Jeremy Hunt reversed most of Kwarteng’s measures – and many lenders are still reviewing their prices. In early January, the Financial Times reported that TSB had slashed rates on its five-year fixed rate mortgages from 6.29 per cent to 4.99 per cent, while Nationwide cut rates 0.55 percentage points to 4.89 per cent.”