Autumn Budget 2017

What does the Autumn Budget 2017 mean for the property market?

Phillip Hammond presented the Autumn Budget 2017 to Parliament today and it included a few announcements that will affect the property industry. I’ve gone through the speech and the initial analysis in the media to look at the implications.

What wasn’t in the budget

There was no retraction of the tax changes imposed on landlords in the private rental sector, which have been in effect since this April (https://www.purplefrogproperty.com/blog/landlord-tax-changes-begin-take-effect-april/).

Before Mr Hammond opened his red box, many were predicting a shake-up of student loans. The speculation was fuelled by the Prime Minister’s comments, at the Conservative conference in October, that fees would be frozen. This would have been a massive boon to landlords with student property, as the change would bring more students into the market.

Instead, the budget fixed a glitch in the current system, which has seen graduates overpaying their existing loans.

Stamp duty cut for first-time buyers

Effective from one minute past midnight on the 22nd November, stamp duty will be abolished for first-time buyers who are purchasing properties up to £300,000. For properties purchased at a value up to £500,000, no stamp duty will be paid on the first £300,000.

Below is a table, highlighting Stamp Duty before and after the change.

| Stamp Duty changes for first-time buyers | ||

| Property price | Stamp Duty before budget | Stamp Duty now |

| >£125,000 (England and NI) | £0 | £0 |

| >£145,000 (LBBT Scotland) | £0 | £0 |

| >£150,000 (England, Wales, NI) | £0 | £0 |

| £200,000 | £1,500 | £0 |

| £300,000 | £5,000 | £0 |

| £400,000 | £10,000 | £5,500 |

| £500,000 | £15,000 | £10,000 |

| Above £500,000 | No change | No change |

Stamp duty for those who already own a property will remain unchanged (https://www.purplefrogproperty.com/blog/stamp-duty-alert/).

The change is expected to enable 80% of first time buyers to avoid paying stamp duty all together.

Figures from lender Halifax show that the average purchase price for first time buyers is approximately £210,000, which means the potential saving will be about £1,700.

The Office for Budgetary Responsibility (OBR), highlighted the cliff edge which will be created with those first-time buyers purchasing a property for £500,0001 paying £5,000 more stamp duty than someone paying £500,000. This is bound to distort property values at this price point.

The OBR have also predicted that the changes to stamp duty will have a result of increasing all house prices by 0.3%. This means that a first time buyer purchasing a property valued at £200,00 will now pay £200,600, meaning the net effect of the change to stamp duty will be a reduction of cost by £900 rather than the £1,500 headline figure.

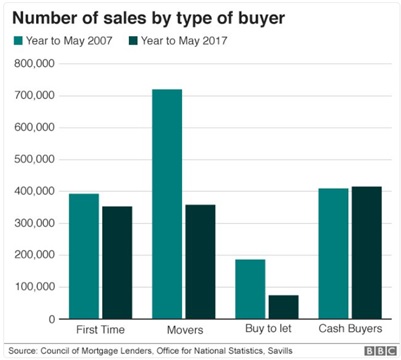

The graph below shows the number of sales by type of buyer in the year to May 2017 compared with the year to May 2007.

Capital Gains Tax

Given just three lines in the Chancellor’s speech, this announcement will potentially cost companies huge amounts in Capital Gains Tax in the future.

Large numbers of property owners and investors have transferred their properties into companies over recent years to avoid the reduction in tax relief for buy-to-let investors.

The way Capital Gains Tax is calculated for companies is different from the method used for individuals. Companies currently benefit from the corporate indexation allowance. This allows for the effects of inflation when calculating the chargeable gains of an organisation.

The Chancellor announced a proposal for freezing the indexation from January 2018. This means that the full gains generated by businesses from that point will be taxed at the general rate of corporation tax. While any historic relief will remain, some commentators are advising companies to plan for the relief to be withdrawn entirely in the future.

The Telegraph have provided a worked example:

“Assume a landlord bought a property within a company in March 2001 for £120,000, and sold it in October 2017 for £200,000. The gain is £80,000.

Under the current system of indexation relief you apply an ‘indexation allowance’ on your period of ownership. This figure is supplied by HMRC and for the period concerned – March 2001 to October 2017 – is 0.5999. You multiply this factor by the price you originally paid. So, £120,000 x 0.599 = £71,880.

You then take away your indexation from the profit, leaving you with £8,120. The indexed gain of £8,120 is then subject to corporation tax at 19%, totalling £1,542.80.

By contract, after the indexation is scrapped, if the property in the example above were purchased on 15 Jan 2018 for £120,000 ands sold in May 202 for £200,000 the gain would be £80,000.

No indexation would be available and the total gain considered would be the £80,000. This means the tax, at the now reduced 17% rate would be due on the full £80,000, totalling £13,600.”

There was a small amount of good news for buy-to-let investors who sell properties outside of a company as the Chancellor announced that the plans to make them pay CGT within 30 days of selling a property were deferred until April 2020 meaning investors will continue to have until the date of their next tax return to pay the tax until then.

House Building

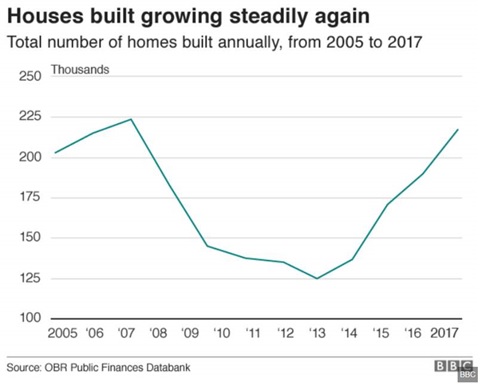

The Chancellor also committed to building more new homes, aiming to build 300,000 new homes per year by 2025 which would be the biggest increase in housing supply since 1970.

The graph below shows house building volumes in the UK since 2005.

Although the government is committing £44bn for housing through capital funding and guarantees, commentators are still not sure what that will mean in practice. BBC’s Laura Kuenssberg tweeted “Sounds like a lot but not clear what it means, underwriting borrowing and giving house builders guarantees not the same as spending cash on putting spades in the ground.”

Mr Hammond does not seem to want all of these new homes built by the national house builders, saying “we need small building firms in every town and city”.

Will building 300,000 new homes per year impact house prices?

On Sunday, the Chancellor said “Experts generally agree that to start to make inroads on the affordability programme we’ve got to be sustainably delivering around 300,000 homes a year.” Is he right? Will that number of new homes have an impact on house prices?

The BBC Reality Check team’s verdict is “Experts seem to agree on 300,000 as a good starting point but there is no universal confidence that it would make much difference to affordability.

The figure of 300,000 was recommended by a House of Lords economic affairs committee report last year. The report described it as “the minimum annual amount needed to meet demand in England and have a moderating effect on house prices”.

Mr Hammond tried to address some questions about how and where these properties will be built: “Solving the housing challenge takes more than money, it takes planning reform. We will focus on the urban areas where people want to live and where most jobs are created making best use of our urban land and continuing the strong protection of our green belt in particular, building high quality, high density homes in city centres and around transport hubs.”

Long term tenancies

The government will be launching “…a consultation on barriers to longer tenancies in the private rented sector, and how we might encourage landlords to offer them to those tenants who want the extra security”.

This is in addition to two other consultations in the property sector which are currently running, (https://www.purplefrogproperty.com/blog/consultations-lettings-and-sales-markets/) the first of which closes on 29th November 2017.

The last Labour Party Manifesto pledged to make three-year tenancies “the norm”, which would cause lots of problems in the student accommodation market.

Empty property council tax

Since April 2013, councils have been able to charge 50% extra council tax to owners of properties which have been unoccupied and unfurnished for two or more years.

The Chancellor today announced that he would extend the powers of councils to increase the surcharge to 100% in an attempt to “…address the issue of empty properties. It can’t be right to leave property empty when so many are desperate for a place to live.”

Sources

http://www.bbc.co.uk/news/business-42055623

https://www.theguardian.com/uk-news/2017/mar/08/key-points-of-budget-2017-at-a-glance-analysis

http://www.bbc.co.uk/news/live/business-42026814

http://www.telegraph.co.uk/money/consumer-affairs/councils-handed-power-double-tax-empty-homes/

https://www.landlords.org.uk/news-campaigns/news/labour-manifesto-2017-whats-in-it-landlords

https://www.lovemoney.com/news/67535/uk-autumn-budget-2017-date-predictions-rumours